There have been a number of exciting updates to QuickBooks online since October 2022 and we would like to show you what these are and how they can help you manage your business activities.

A few of the ones that we’ll be talking about in this article are The New Business Navigation Tab; Prep for Taxes Firm Workflow Update; and The Getting Started Hub.

1. New Business View Navigation Tab

QuickBooks Online has launched a new navigation experience called Business view and it’s got everyone talking. The rollout began early October, and we expect full availability by mid-December. It is super user friendly and has been designed to help with the day-to-day tasks of small business owners.

Here’s what to expect:

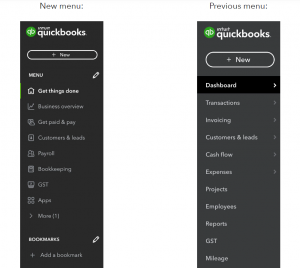

The QuickBooks Online navigation bar is changing for you to find what you need more quickly and easily. You’ll see a consolidated menu and new terminology by selecting Business View from the account settings. This simplified menu was designed due to popular demand and makes navigating QuickBooks more intuitive.

The previous menu (called Accountant menu) is still available, and you can easily switch between the two.

Customisation Features:

The new Business View contains the same features as the current navigation — it’s just organized to better suit the needs of business owners.

Some of the changes include:

- The Business overview menu is now home to Cash flow, Reports, Planner, and Projects.

- Get paid & pay is home to the Customers, Invoices, Time, and Suppliers.

- Payroll is home to Payroll features and Time

- Bookkeeping is home to Transactions, Banking, Expenses, Chart of Accounts, and Tags

- And you now have the ability to bookmark the pages you use most; hide the menu items you don’t use; and reorder navigation menu items and bookmarks.

Hiding a page or menu item won’t remove functionality from your QuickBooks, it just moves it out of the way so you can focus on what matters most. You can find your hidden items under “More” and restore them in Menu Settings.

When you customise your menu, the changes will only be visible to your individual account. They won’t change the experience for other users that might be connected to your subscription (like your Accountant or Bookkeeper).

2. Prep for Taxes firm workflow update for Accountants

The ‘Prep for taxes’ or Trial Balance feature is designed for accounting professionals to simplify year-end accounting processes by giving them easy access to documents. Its goal is to save time and resources required to gather formal reports and financial statements at year-end.

It gives the accountant the ability to finalise your clients’ books from a single screen and direct integration with QuickBooks Tax help you finish the year off faster than ever before.

Now you can see who has prepared and reviewed each account, helping you to gauge where the accounts preparation process is up to—saving you time when changes or further clarification is needed and giving you greater oversight and accountability.

This feature is available in QuickBooks Online Accountant edition and is accessible through the accountant dashboard through the Accountant Tools. All information and notes entered into the ‘Prep for taxes’ is automatically saved and is only made visible to Accountants and Bookkeepers.

Feature highlights

- Trial Balance activity timeline: a filterable timeline that displays client and Accountant activities impacting balances.

- Make adjustments in Trial Balance: one-click access to transaction details.

- Add notes and attach documents that will only be visible to you and your firm.

- Other transactions: shows all non-adjusting journal entries and re-classified transactions.

How to access Prep for taxes

- Sign in the QuickBooks Online Accountant firm where you’ll see the client you were granted access to.

- Select Prep for Taxes from the Accountant Tools section.

- The screen will display a Documents section. Select the sub tab called Review & adjust. You can also browse for documents, drag and drop, or leave notes for team members under the Prep for taxes column.

3. Getting Started Hub

Another new feature that QuickBooks have just launched is the Getting Started Hub. This is probably one of the most useful resources to help new QuickBooks users or advisors get up to speed. It offers a simple step by step guide on how to get started by showing you how to connect your bank account with just a few clicks. By connecting your bank accounts to QuickBooks Online, you can easily track the profitability of your business.

It also covers how to import your spreadsheet data such as your Bank Data; Customers; Suppliers; Chart of Accounts; Products and Services; Invoices as well as Bills. Which, by the way, also needs to be uploaded in that exact order. Payroll has never been easier for first timers with a full tutorial of how to run your first pay run as well as how to prepare and lodge your BAS.

With all these new features at your fingertips you really can’t go wrong. It’s no surprise as to why QuickBooks is seen as one of the best, and most popular, accounting software options available for businesses.