Major advancements in modern technology have increased demands for accuracy and convenience and recent legislation has made cloud accounting software a must have tool for Australian business owners. With its accessibility over various devices and the fact that data can easily be transmitted to users while still being protected, it is clear why cloud accounting is used by many. The increasing demand for competent software resulted in a number of cloud accounting software products to choose from with each one having distinct features. With all these programs, how does one decide which one is best for one’s needs? Here is a quick comparison of the 3 major cloud accounting software in Australia.

All of these companies have respectable reputations and are government certified. The ultimate goal then, in comparing these software programs is to find one that is the right fit for your needs by looking at their basic functionalities, their add-on programs for complex transactions, their subscription rates, and other additional features which may be helpful such as mobile applications.

Background of each Cloud Accounting Software Program

Xero

New Zealand-based Xero is one of the newest among the 3 programs, entering the Australian market only in 2008 and now raking in more than 1 million subscribers from all over the world. Focusing only on cloud accounting software, it has been able to take a lead over its competitors for a time because it did not have to focus on making products for the traditional accounting software market.

MYOB

In contrast, MYOB has been in the business of providing bookkeeping and accounting services in Australia for a long time since 1991. MYOB has since been a dominant player in traditional accounting bookkeeping software and has now entered the cloud bookkeeping market.

QuickBooks

Intuit has American roots. Founded in 1983, this company’s share of subscribers continues to grow. Just at 2014, they already obtained 624,000 subscribers. One of its strengths include its high functionality across multiple devices while maintaining access to its services at a low cost.

Comparison of Features

Price

Perhaps for a small business owner, the price may be one of the most important considerations and so this will be the first comparison to be made. The 3 programs have different price schemes so there is no clear-cut comparison. Often, they would have a basic program package with a base price and you could order a “premium” which may have more features or more payroll.

For instance, MYOB offers 3 packages: MYOB Essentials Starter, MYOB Essentials Payroll, and MYOB Essentials Unlimited Payroll. At $25 per month, the first package allows you to send up to 5 invoices, up to 25 bank transaction feeds and payroll for 1 person. The second package, at $40/ month allows for payroll for 1 person but provides up to 250 bank transaction feeds and an unlimited number of invoices. The final package, at $50 per month also allows for unlimited invoices, and up to 250 bank transaction feeds but, as the name suggests, it allows for an unlimited number of employees for payroll.

Xero has 3 packages with similar offerings like MYOB: Xero Starter, Xero Standard, and Xero Premium. Xero Starter has a rate of $25/month which allows you to send up to 5 invoices and quotes, pay 1 person and reconcile 20 bank transactions. Xero Standard, at the rate of double that of Xero Starter ($50) allows for unlimited invoices and quotes to be sent and allows you to reconcile an unlimited number of bank transactions. Xero Premium is at $60/month and is just like Xero Starter except you can now pay up to 5 employees. Another bonus is that it allows you to handle different currencies.

QuickBooks is relatively more affordable in comparison to the first two and given that it offers similar functionalities, it is recommended for those just starting out their business. It comes in 4 packages, including its mobile application. These are the QuickBooks Mobile Appa at $10/month, QuickBooks Simple Start at $16.50/month, QuickBooks Essentials at $27.50/month and QuickBooks Plus at $38.50/month. The features of the mobile app are discussed in a different section later. As to the second package, its features include payroll for up to 10 employees, tracking sales and expenses and also sending unlimited invoices. The Essentials package also offers the same features but it also allows you to manage and pay bills, transact in multiple currencies and generate sales quotes. The final package allows for track inventory, purchase orders to be created and for you to track project or job profitability.

User Interface

Although each software has its own unique aesthetic layout, they all have similar functions. It would be advisable to take advantage of the 30-day trial period these programs offer to best “get a feel” of their interface and whether it works for you. People of different preferences will be able to select which program suits them best. A smooth interface makes a great deal of difference in terms of efficiency, accuracy and cutting down on data entry and data processing time.

QuickBooks Online is great in that although it has numerous features, its design does not overwhelm the user. The left-hand navigation pane shows all the categories you need making it easy to find the tab you are looking for from All Sales to Invoices to Products and Services List. The manner by which you enter an item in my account and how you entered it makes you bound by how these are mapped. This may be more tedious but it can easily be changed by altering the mapping at the products and services list. More complicated tasks are hidden until activated such as the cost centre reporting. This may not be to the liking of those people who may have been used to other programs and may expect certain functions in certain places.

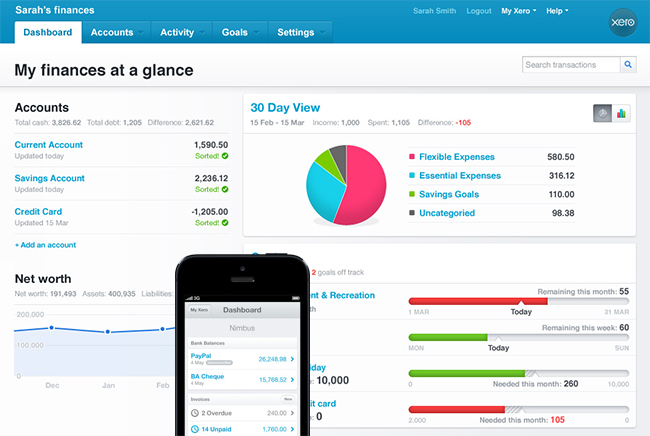

In that case, Xero may be a better choice because of familiarity. The tasks and functions are easily located where they are often expected to be. Not only does it make Xero handy for primary bookkeeping functions, but it also provides flexibility which other programs may not offer. For instance, a product mapped to an income account may easily be changed to another account while remaining in that transaction. Other programs do not have this option.

If you are someone who is completely new to these programs, perhaps you would prefer MYOB Essentials. Its interface is designed for the layman. For instance, instead of using technical terms, it uses terms like “Money In” and “Money Out” instead which makes it perfect for people with no technical bookkeeping knowledge. The downside to its simplicity is also the fact that the functions available are limited like for instance the Profit & Loss statement cannot be viewed by month.

Monthly Reports

In Xero, to obtain a monthly balance sheet, you need to run the data for the last month in the period you are looking at before comparing it to the first 11 months. The display layout shows the monthly reports from the latest month to the oldest.

In QuickBooks, to obtain a monthly report, you need to run the report for the date range and choose from the options in the top portion to show the columns per month.

User Limit

Xero has no limit on the number of users that can use the software which can be really useful if you are an expanding business with multiple personnel. The other programs are limited to a fixed number of users.

The number of users allowed for MYOB depends on the version. For MYOB accounting, it starts with 1 user while MYOB premier can accommodate up to 15 users. When multiple users use the program at the same time, however, it may slow it down but it can be resolved by using add-on software.

For QuickBooks, the QuickBooks Essential allows for a maximum of 3 users while Quickbook Plus has a maximum limit of five users.

Additional Features

Bookkeeping functions are already integrated into the basic software programs but for specific needs, you can install add-ons. There are many add-ons available depending on your specific needs whether it be for quoting, inventory tracking or stock management. A cursory search would reveal that MYOB has around 20 certified add-ons (http://myob.com.au/addons/) and Quickbooks has around 140. Xero has the greatest number of add ons, reaching up to 400, most likely because it was also one of the first that ventured into cloud accounting (https://www.xero.com/us/bookkeepers/products/). Xero is perfect if you have very specific accounting needs but if you just want basic bookkeeping, it might not be advisable given its price.

Mobile Applications

Initially, MYOB was behind as it did not have a mobile application but now they have released the MYOB Invoices app which allows one to send invoices straight from their mobile device which when sent, immediately updates across your MYOB software. Aside from this, the mobile-only has contacts and payments functions.

Xero and QuickBooks have mobile applications available for their software as well which allows you to prepare invoices and quotes as well as scan receipts. QuickBooks Online also does bank reconciliations and balance sheet reporting. Payments can be made using a Paypal card reader and app and the Tablet version of the app has a GPS and location-based prefilling for more convenient inputs for invoices. For Xero, third-party apps are used for payments such as Paypal Square and Ezidebit.

All of them have an organized and user-friendly layout which definitely makes updating statements hassle-free.

Customer Support

Customer support is crucial not just for the company to establish rapport with its subscribers but also for customers who may have some difficulty adjusting to cloud bookkeeping or those who may not have accounting know-how. Thus, customer support may be another determining factor in choosing the right software.

QuickBooks has unlimited email, phone a live chat customer support from 9 am to 9 pm on Monday to Friday included for free as part of the package. It also provides for a searchable FAQ section and helpful forum categories.

MYOB also has an efficient customer support system. It has community forums where relevant topics regarding issues users may experience, are found. There are also online documentation and training videos that teach users how best to use their product. Aside from this they also have a phone line with agents ready to assist users available from 9 am- 5 pm every day of the week.

Xero does not provide phone support unlike its competitors but it does have a huge social media following where they can post articles and other users can interact with them. They also have community forums and online documentation and training videos which may assist the users. This is an additional help considering that the software itself is already easy to use for non-accountants.

Conclusion

All of these companies offer great cloud accounting software programs that can make your lives easier by aiding you with your business endeavors. Each one can provide you with the basic tools you need for bookkeeping services and monthly reports. Ultimately, however, finding the right software program to use is contingent on your unique needs and preferences.

Related articles

Other References:

https://361dc.com/blog/xero-vs-QuickBooks-vs-myob–which-is-the-best-accounting-software

https://cruzandco.com.au/xero-vs-QuickBooks-online-vs-myob-essentials/

https://www.fundera.com/blog/QuickBooks-online-vs-xero