Running a plumbing business is demanding work. Between scheduled jobs, urgent call-outs, and chasing clients, bookkeeping usually ends up at the bottom of the list. However, it’s there in the back of your mind, knowing that falling behind on invoices, receipts, and BAS can end up costing you money and getting you into trouble. That’s why so many small business owners end up working more than a full-time job catching up on admin in their spare time. This article will teach you simple ways to stay on top of your accounts, outline the best software for tradies, and detail when it’s time to call in a professional. By the end, you’ll know how to keep your plumbing business accounting under control without it taking over your whole week.

Good plumber bookkeeping keeps your cash flow healthy and your business running smoothly. With accurate records, you’ll always know what money is coming in and going out, making it easier to pay suppliers on time, keep any staff wages covered, and handle unexpected costs without stress. Job costing is another major benefit of staying organised. By tracking expenses, materials, and labour for each project, you can ensure you’re charging the right amount and maintaining profitability across all jobs.

Compliance with BAS and ATO requirements is also critical. Accurate small business bookkeeping makes lodging GST and PAYG straightforward, while helping you avoid costly penalties or audit issues.

Finally, consistent bookkeeping gives you the insights you need to grow. You can see which jobs bring the best margins, which clients are the most reliable, and where money may be slipping through the cracks.

Plumbers, like most tradies, often face particular bookkeeping challenges that can make it difficult to run the business efficiently. Between juggling busy job schedules and keeping up with paperwork, it’s easy for receipts to go missing or for personal and business expenses to become mixed together. It might seem easier to do your finances this way at first but as your business grows, tax reporting becomes complicated, and mistakes become more likely. You might also find yourself skipping regular bank reconciliation as there’s simply no time, but this can easily lead to errors, cash flow issues, and stress at tax time.

If you fall behind or bookkeeping is just causing too much stress, outsourcing may be the way to go.

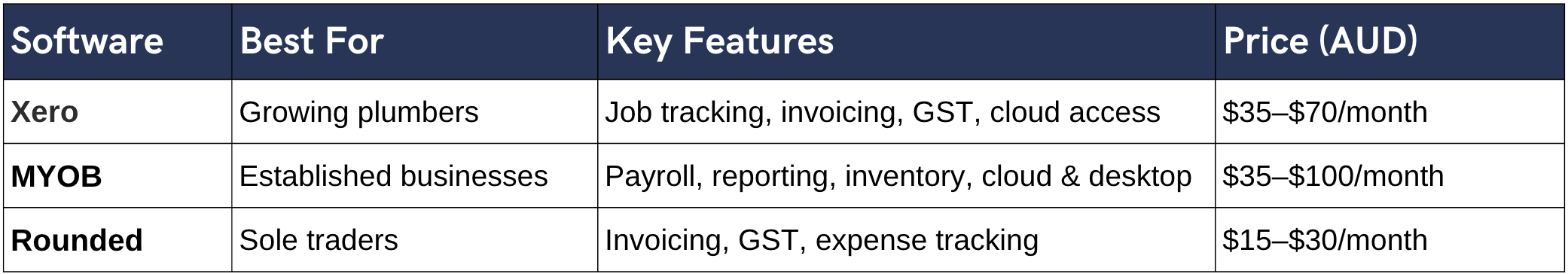

Xero for plumbers is great if your business is growing. It links with job management tools so you can track labour, materials, and invoices all in one place.

MYOB plumbing business solutions suit established businesses. It handles payroll, reporting, and more complex accounting needs.

Rounded is ideal for sole traders or very small plumbing businesses. It’s simple, affordable, and focused on small business bookkeeping.

The last thing any plumber needs is a surprise from the ATO. Staying on top of your BAS lodgements keeps everything compliant and stress free. With accurate bookkeeping, your accounts stay up to date, GST and PAYG calculations are straightforward, and you always know exactly what you owe and when it’s due. It’s a lot like the difference between keeping a job site tidy and making a mess. When everything is organised, the work flows more smoothly because you’re not wasting time looking around for tools.

If you find yourself constantly chasing invoices, missing BAS deadlines, or losing track of job costs, it may be a sign you need help. Bookkeeping services for tradies takes care of reconciliation, invoicing, and even dealing directly with the ATO, saving you time and reducing stress.

A bookkeeper who understands plumbing businesses knows the typical expenses and reporting requirements you face, so your accounts stay accurate and compliant. With that support, you can spend less time buried in admin and more time focusing on your work and growing your business.

Keep your plumbing business running smoothly by setting up good systems early. Start by separating business and personal accounts, keeping all your receipts in one place, and choosing bookkeeping software that suits your workflow and business size. Block out a little time each week to stay on top of reconciliations, invoicing, and expenses. These small habits save time, cut down stress, and keep your accounts in order.

For bigger or more complex tasks, a plumbing bookkeeper can step in to make sure everything is accurate and compliant. If you’d like tailored advice, call us on 1300 728 875 or send an enquiry. For more practical tips, explore our guide on Bookkeeping for Tradies.

Use accounting software to manage invoices, payments, and GST automatically. Log receipts as soon as you get them, and reconcile your accounts weekly. Doing a little bit regularly is much easier than leaving everything until the end of the month. This keeps your records accurate and reduces stress at tax time.

One of the most common mistakes is mixing personal and business expenses. Using the same bank account or credit card for both makes tracking income and costs confusing. It can lead to errors when preparing BAS, reconciling accounts, or checking profitability. Keeping accounts separate and recording each transaction helps you avoids these problems.

Single-entry bookkeeping is the simplest method. You record each income or expense once, creating a straightforward list of transactions. It’s easy to manage, doesn’t require advanced accounting knowledge, and is perfect for small businesses or tradies who want to spend more time on their work than on paperwork.

QuickBooks is cloud-based software that helps small businesses manage invoicing, expenses, and GST. You can log transactions on the go, track payments, and generate reports without spending hours manually updating spreadsheets. It’s especially useful for tradies who need a simple system to stay on top of their finances.