Two terms that every business owner needs to understand are accounts payable and accounts receivable. They may sound technical, but they are simple to understand and crucial for keeping cash flow steady, making informed financial decisions, and ensuring the long-term success of your business.

Put simply, accounts receivable is the money that customers owe you, while accounts payable is the money you owe to suppliers and service providers. Together, they give you a clear picture of where your business stands financially. In this article, we will break down these meanings, give you practical examples of each, and compare them side by side. You will also learn some bookkeeping basics for managing them more effectively so you can keep your business finances on track.

Accounts payable, often referred to as AP, is the money your business owes to others. It represents the short-term obligations that need to be paid to keep your business running smoothly. In other words, accounts payable meaning is any outstanding bills or debts your business is responsible for paying.

Common examples of accounts payable include supplier invoices for stock or materials, utility bills such as electricity, water, and internet, and lease payments for office or retail space.

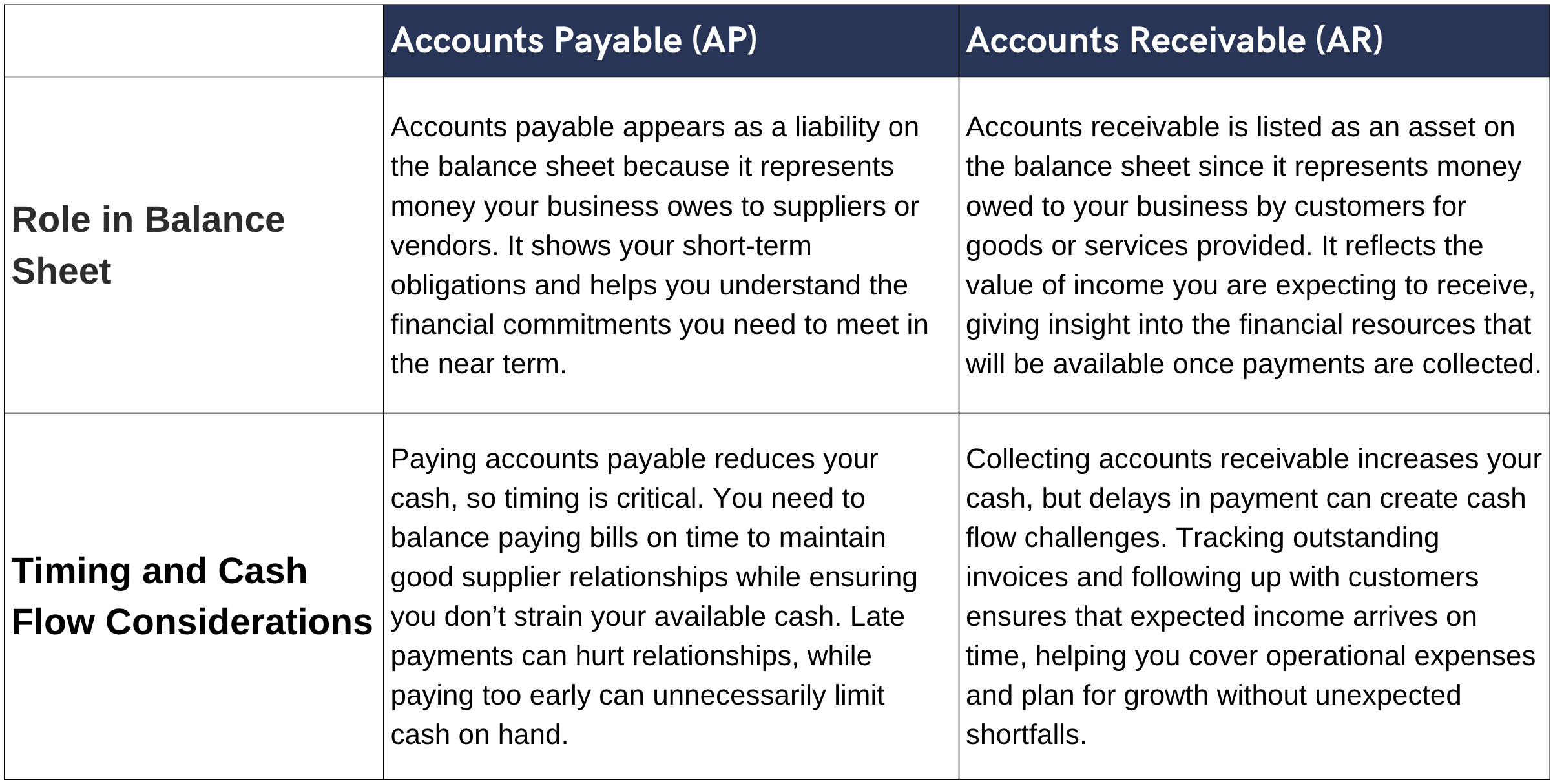

When it comes to cash flow, an increase in accounts payable means your business is spending cash. Managing AP carefully ensures you make your payments on time, avoid late fees, and maintain good relationships with suppliers.

Accounts receivable, often referred to as AR, is the money owed to your business by customers. It represents the sales you have made but have not yet been paid for.

Examples of accounts receivable include customer invoices waiting to be paid, credit sales where customers are billed after delivery, and subscription payments that are invoiced at the end of a billing cycle.

The faster your accounts receivable are collected, the more cash flow you have to reinvest in your business. If receivables are delayed, it can restrict your ability to cover expenses or expand.

When you know exactly what money is owed and what is due to come in, you can prevent cash shortages that could disrupt or slow down your operations. Accurate records of AP and AR also protect you from costly errors, like paying an invoice twice or overlooking incoming payments. Most importantly, keeping track of both sides gives you the insight to make smarter business decisions. You’ll know when it’s safe to invest, when it’s time to cut costs, and when to chase up overdue payments to keep cash flowing.

One of the best ways to stay on top of accounts payable and accounts receivable is by using accounting software. Tools like Xero, MYOB, or QuickBooks make tracking both incoming and outgoing payments easier and more accurate. It also helps to set clear payment terms so that customers and suppliers know exactly when payments are due. Following up promptly on late payments prevents small issues from becoming big problems. Finally, maintaining accurate records is essential, as a well-organised ledger not only helps avoid errors but also ensures compliance with reporting standards.

The difference between AP vs AR comes down to money going out versus money coming in. Both are equally important for understanding your cash flow, financial health, and business growth. By managing them effectively, you can reduce financial stress and set your business up for long-term success.

If you want professional support to streamline your accounts payable and accounts receivable processes, Darcy Bookkeeping & Business Services can help. Out team offers specialised services to take the stress out of managing your finances and ensure your business stays on top of cash flow. Click here to learn more about:

We help businesses stay on top of their accounts payable and receivable, so you can focus on running and growing your business with confidence. Send an enquiry or call us on 1300 728 875 to see how we can simplify your bookkeeping.

Neither is better. Accounts receivable brings money into your business, while accounts payable tracks what you owe. Both need to be managed carefully. A healthy business balances incoming cash with timely payments to suppliers.

In small business accounting, one person often handles both accounts payable and receivable. Larger organisations usually separate these roles to reduce mistakes and keep payments and collections efficient.

If you receive an invoice to pay, it goes into accounts payable. If you issue an invoice to a customer, it becomes your accounts receivable. From the customer’s side, your invoice will be managed by their accounts payable team.

Payable is money you must pay out, while receivable is money you are set to receive. Think of AP as cash leaving your business and AR as cash coming in.