Managing partial payments is a common part of running a business. Recording these correctly in your accounting software matters because it keeps your books accurate, avoids reconciliation issues, and maintains clear cash flow visibility. Both Xero and MYOB provide straightforward ways to handle partial payments, but the process can be confusing if you’re not familiar with the steps. This article will walk you through how it works in both systems, provide solutions to common mistakes and give you some practical tips to take the stress out of invoicing.

Partial payments are payments that cover only part of an invoice. Your client doesn’t pay the full amount at once. Instead, they pay in instalments or smaller amounts. This can happen for many reasons such as lack of funds, large and expensive projects or catching up on overdue invoices.

Partial payments affect your cash flow, your accounts receivable, and your reconciliation processes. Handling them correctly ensures your records always match your bank statements.

Start by creating a standard invoice in Xero. Include all relevant details: client, description of goods or services, and the total amount. Make sure your invoice terms are clear. You can specify due dates and payment instructions.

When a client pays part of an invoice, follow these steps:

Xero will now show the invoice as “Part Paid.” You can see the remaining balance clearly.

Reconciling partial payments in Xero is straightforward. When you reconcile your bank feed, match the part-paid invoice with the bank deposit. Xero will adjust the outstanding amount automatically.

When the client pays the remaining balance later, open the same invoice again. Add the new payment. Xero will reduce the outstanding amount accordingly.

One common error when managing partial payments in Xero is recording the full payment instead of the actual partial amount received. This often happens when users are in a hurry or are unfamiliar with the system. To fix this, you can delete or edit the incorrect payment and then re-enter the correct partial amount by navigating to Business > Invoices > Receive a payment.

Another frequent mistake is allocating a partial payment to the wrong invoice. The solution is to remove the incorrect allocation from the invoice’s payment history and re-apply it to the correct invoice. Double-checking customer and invoice details before applying payments can prevent this error.

Not reconciling the bank transaction is also a common issue. To resolve this, go to Bank Reconciliation, locate the imported bank transaction, and match it to the recorded partial payment.

Some users mistakenly use the “Overpayment” feature instead of recording a partial payment. This can create phantom balances and errors in reporting. The fix is to void the overpayment and then apply the correct partial payment directly to the original invoice.

Start with a standard invoice in MYOB. Add client details, items, quantities, and total amounts. Include due dates and payment instructions. This helps when part-paid invoice MYOB entries occur.

The invoice now shows as part paid. You can still see the outstanding balance clearly.

Reconciling partial payments MYOB involves matching bank transactions to the part-paid invoice. Go to the Banking or Reconciliation section. Select the deposit and match it to the invoice. MYOB updates the remaining balance automatically.

Sometimes clients overpay or make multiple partial payments. MYOB allows you to apply credit notes or allocate payments across several invoices. This keeps your accounts receivable partial payments accurate.

A frequent mistake when recording partial payments in MYOB is entering the full invoice amount instead of the actual partial payment received. To fix this, open the invoice in Sales > Receive Payments, delete any incorrect payment entry, and re-enter the correct partial amount. Always double-check the payment figure before saving to ensure accuracy.

Another common error is applying a partial payment to the wrong invoice or customer account. This can happen if multiple invoices are open for the same customer. To correct it, locate the misapplied payment in Sales Register > Payments, remove it from the wrong invoice, and re-apply it to the correct one. Confirming the invoice number and customer details before posting payments helps prevent this mistake.

Not reconciling the payment against the bank transaction is another issue that can lead to mismatched balances. Even if the partial payment is recorded, failing to reconcile it in Banking > Reconcile Accounts may leave your bank statement out of sync with MYOB.

Sometimes, businesses forget to record subsequent instalments after the first partial payment. This leaves invoices appearing overdue. Each time a payment is received, open the original invoice and record the amount under Receive Payments until the full invoice total is cleared.

Finally, failing to update allocations when a credit note or discount is applied can leave an invoice balance inaccurate. To resolve this, select Allocate Credit on the invoice and apply any applicable credit or discount so the outstanding balance reflects the true amount owed.

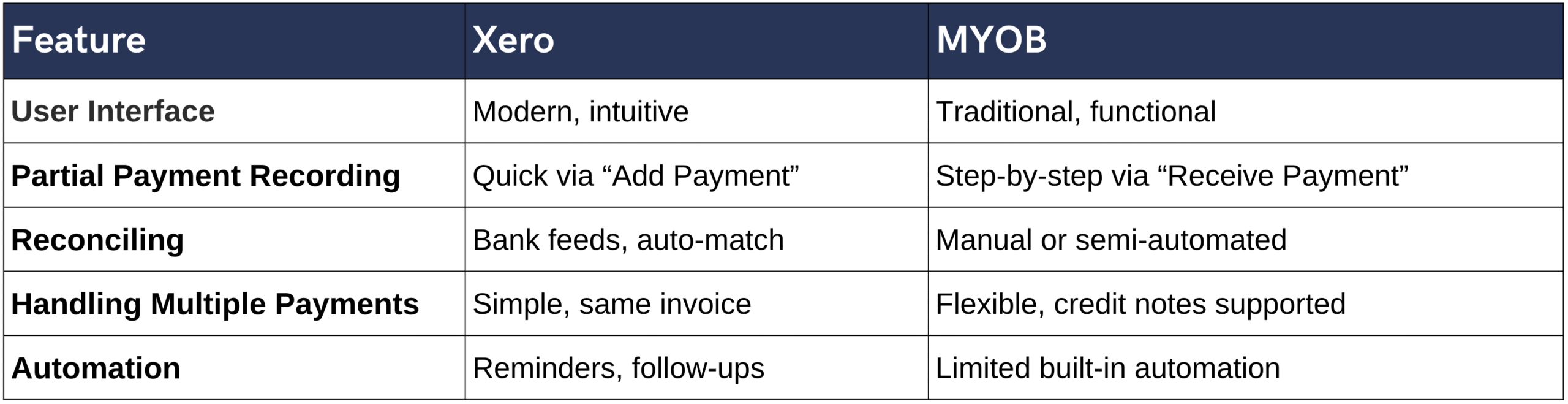

Both Xero and MYOB handle partial payments well, though they each have their own strengths. Xero offers a modern, user-friendly interface and plenty of automation, making reconciliation with bank feeds simple and adjusting invoices for future payments quick and easy. MYOB, on the other hand, provides flexibility; allocating multiple payments or applying credit notes is straightforward, though its interface has a more traditional feel that might take a little getting used to.

Overall, Xero vs MYOB partial payments handling depends on your workflow. Xero is faster for smaller businesses. MYOB works well for more complex invoicing scenarios.

Communication is key. Take the time to confirm payment amounts and due dates with your clients. Clear invoice terms help everyone stay on the same page and reduce confusion.

Use reminders to stay on track. Automating notifications and follow-ups in Xero or MYOB can make it easier to receive payments on time. Consistently tracking partial payments helps keep your accounts receivable organised and stress-free.

Stay on top of part-paid invoices. Regularly reconciling payments and gently following up on outstanding balances ensures nothing slips through the cracks. Keeping accurate records also makes end-of-month reporting a lot smoother.

Be sure to record partial payments in Xero and MYOB as soon as the funds arrive. Keeping your invoices up to date and double-checking entries makes managing part payments much easier.

Partial payments don’t have to be stressful, and support is always available if you need it. For extra guidance, you can explore professional help at Darcy Services Accounts Receivable or call us on 1300 728 875.

Open the invoice, click “Add Payment,” enter the amount received, and save. Xero will update the remaining balance automatically.

Go to Sales > Open Invoice > Receive Payment. Enter the amount received, select the bank account, and save the transaction.

Use the Receive Payment function multiple times or apply part of a single deposit across multiple invoices. MYOB allows flexibility with allocations.

A contra payment offsets an amount owed with a payment due. Open the invoice, select “Receive Payment,” and choose the contra option to apply it.