Having access to money when it’s needed is critical to the success of any business, but even more so for small businesses. If you can’t pay your suppliers or your staff dependably, it’s a red flag that you need to get on top of managing your cash flow, spend time on cash flow forecasting and put some budgets in place. Thankfully there are tools to help make this job easier. In this article we’ll discuss the features and benefits of Cashflow Manager accounting software.

What is cash flow management and cash flow forecasting?

Cash flow management is the process of tracking and monitoring actual ‘money in’ and ‘money out’ of a business. This is different to tracking sales (accounts receivable) and bills (accounts payable), where the money in or out might not happen until a week or a month’s time, or even further into the future. Cash flow management is concerned with the net amount of money on hand after (actual) expenses have been deducted.

Cash flow forecasting refers to analysing current and projected accounts receivable and accounts payable (as well as other business income and expenses such as grants, loans, and taxes) and anticipating when the money is likely to be received or will need to be paid. These forecasts can be for a point of time in the near future or even years further down the track. Cash flow forecasting helps you make informed business decisions so you can budget for difficult economic times and also identify opportunities to expand and grow.

Need help managing your business cash flow? We have been providing bookkeeping and accounting services to Australian businesses for over 10 years, finding ways to alleviate their cash flow stress so they can stay afloat and grow. Contact us today on 1300 728 875 or send us a message.

Introduction to Cashflow Manager

Cashflow Manager is accounting software that helps businesses:

- Track their income and expenses

- Create budgets

- Generate reports.

It is a simple and easy-to-use tool that can help you keep on top of your finances, especially if your business receives a lot of cash payments rather than bank transfers. The company is headquartered in Adelaide, South Australia so the software is designed to meet the needs of Australian businesses.

There are two tiers of Cashflow Manager products available:

- Cashflow Manager (standard)

- Cashflow Manager Gold with payroll.

There are also other payroll-only products available from Cashflow Manager:

- Wages 1-4 – for small businesses with up to 4 employees

- Wages Manager – for larger businesses.

Refer to the table below for a comparison of the different inclusions and prices.

They also sell a hard-copy book for recording bookkeeping transactions manually. We only recommend you use this method if you don’t have reliable computer and internet access at your place of business.

Cashflow Manager Subscription Options

| Cashflow Manager Standard | Cashflow Manager Gold | Wages 1-4 | Wages Manager |

| Inclusions: - Unlimited Income & Expenses - Unlimited Quotes & Invoices - Manage Customers Reconcile Bank Accounts - Lodge BAS & Tax Reports | Inclusions: - Unlimited Income & Expenses - Unlimited Quotes & Invoices Reconcile Bank Accounts - Lodge BAS & Tax Reports - Unlimited Employees Single Touch Payroll - Track Inventory - Manage Suppliers - Manage Assets & Loans | Inclusions: - Payroll for up to 4 employees - Single Touch Payroll - Leave & Superannuation | Inclusions: - Unlimited Payroll - Single Touch Payroll - Leave & Superannuation |

| Cost: $26 per month# or $284 per year | Cost: $47 per month# or $513 per year | Cost: $9.90 per month# or $118.80 per year | Cost: $35 per month# or $382 per year |

| Optional additions: Import Bank Statements Feed* | Optional additions: Import Bank Statements Feed* |

* for an additional cost of $5 per month

# subscription-based pricing model, minimum of 12 months

Prices quoted are current as at August 2023.

Getting started

You can try out the program with a 30-day free trial and see if its features suit your needs. We recommend you do take up the trial offer before committing to subscribing to Cashflow Manager as their minimum subscription term is 12 months. You can pay monthly or annually but you will be obligated to payout the 12 month subscription if you want to cancel. After the initial 12 months you can cancel your subscription at any time.

Note that Cashflow Manager is only designed to run on Windows PCs and laptops and doesn’t have a mobile app version. Mac users will need to download additional software.

There was a cloud (web) version of the software, Cashflow Manager Cloud, however it was discontinued in July 2023. A new cloud-based product, okke, was recently released.

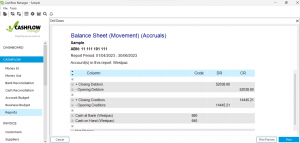

Reports

Here is a list of some of the reports you can generate from Cashflow Manager:

- Income statement

- Balance sheet

- Cash flow statement

- Budget report

- Transaction report

- Custom report.

To generate a report, follow these six simple steps.

- From the dashboard, go to the Reports tab.

- Select the type of report you want to generate.

- Enter the date range for the report.

- Select the filters you want to apply to the report.

- Click the Preview button.

- Save or Print the report

How can Cashflow Manager help your business?

Some of the many benefits to using Cashflow Manager include:

- Saves you time

- Increases accuracy

- Improves decision-making

- Helps your business grow by ensuring you have the cash on hand when needed.

With real-time transaction tracking, you can see where your money is going and make informed decisions about your business. You can also track money owed and pending payments, so you always know where you stand financially.

How does Cashflow Manager compare to other accounting software?

When choosing a cash flow management and forecasting tool, or any accounting software, you’ll need to consider the specific needs of your business. Prioritise the features that are most important to you. These might include:

- Ease of use – how hard will it be for you (or your team) to get started with the program? Is there support provided (by phone or online) if you need it? Can you chat to somebody in customer service if you encounter issues? Are there training video tutorials available to watch online?

- Affordability – will your business be able to sustain the monthly cost / yearly commitment?

- Accessibility – will you have access to a desktop PC/laptop to use the program regularly or would a mobile app be more convenient?

- Flexibility – will a simple accounting solution meet your business’s needs for the next few years or do you envisage that you’ll need to scale up to more comprehensive accounting software? If it’s the latter you might want to go with a program that will easily enable you to upgrade in the future without needing to start over. You can often begin with the more affordable ‘basic’ or ‘lite’ option and add more advanced features over time.

Some other popular accounting software options include:

Below is a table that compares the features of Cashflow Manager, Xero, MYOB, and QuickBooks.

Comparison of Cashflow Manager to Xero, MYOB and Quickbooks

| Feature | Cashflow Manager | Xero | MYOB | Quickbooks |

| Ease of use | Easy to use, even for beginners | Easy to use, with a user-friendly interface | Easy to use, with a simple interface | More complex to use, with a steeper learning curve |

| Affordability | Affordable option for businesses of all sizes | Affordable option for businesses of all sizes | Affordable option for businesses of all sizes | More expensive option, witha variety of pricing plans |

| Flexibility | Can be customised to meet the specific needs of your business | Highly customisable | Flexible, with a variety of features and add-ons | Highly customisable, with a wide range of features and add-ons |

| Security | Secure software that protects your data | Secure software that protects your data | Secure software that protects your data | Secure software that protects your data |

| Reliability | Reliable software that is backed by a team of experienced professionals | Reliable software that is backed by a team of experienced professionals | Reliable software that is backed by a team of experienced professionals | Reliable software that is backed by a team of experienced professionals |

| Level of features | Basic features for tracking income and expenses, creating budgets, and generating reports | A wide range of features for tracking income and expenses, creating budgets, generating reports, and more | A wide range of features for tracking income and expenses, creating budgets, generating reports, and more | A wide range of features for tracking income and expenses, creating budgets, generating reports, and more |

Conclusion

Overall, Cashflow Manager is a good option for micro and small businesses that are looking for a simple and easy-to-use accounting software. It’s also a good option for businesses that are on a budget. If you are looking for a more powerful accounting software, you may want to consider Xero, MYOB or QuickBooks.

Although the price of Cashflow Manager Gold ($47/month) is less expensive than Xero’s Standard plan ($59 per month), the integrations and add-ons available for Xero (many available as mobile apps) make Xero a more flexible option that might save you time and money in the long run.

Are you looking for the right accounting software for your business? Darcy Bookkeeping are experts in the most popular options and can help with your accounting software setup. Contact us today on 1300 728 875 or send us a message.